Artificial intelligence, AI, has taken the tech world by storm, and is dominating tech-related headlines. It seems that every tech company – large and small – is advertising its links to AI, or its AI-related operations and products. AI is everywhere.

Generative AI, the ability of AI to create original materials based on machine learning and massive data stockpiles, only hit the scene in November of 2022, with the release of ChatGPT. Since then, the technology has been extending its reach into more and more applications.

Jefferies’ Blayne Curtis, a 5-star analyst rated in the top 1% of the Street’s stock pros, notes that we are still early in the AI cycle, and that there is still plenty more room for AI’s continued growth.

“Only two years ago AI made up less than 5% of total semis revenue, yet we estimate it will reach nearly 25% of total semi market revenue by 2027… Cloud capex budgets are rising and the runway for growth is expanding as they do. As long as cloud providers continue to foot the bill, the AI group should continue working,” opined.

Against this backdrop, Curtis recommends Nvidia (NASDAQ:NVDA) and Marvell Technology (NASDAQ:MRVL) as top AI chip stocks to buy ahead of upcoming earnings releases. While the software, with its impressive algorithms and performance, is crucial, it depends on increasingly sophisticated semiconductor chips, opening new possibilities for companies that can meet this demand.

According to the TipRanks database, both also get a Strong Buy rating and double-digit upside predictions from the broader Wall Street view; here are the details

Nvidia

First up on our list of Jefferies picks is Nvidia, the fast-growing chip company that is now the third largest publicly traded firm on Wall Street. Nvidia’s recent skyrocketed share price growth has become something of an instant legend among tech investors. In the past year, the company’s stock has spiked some 192%, and is up 87% just for this year to date. Nvidia’s rise has given the company a market cap of $2.27 trillion, making the chip company one of just four two-trillion-dollar-plus behemoths on Wall Street’s trading floors. Nvidia has achieved this dominance mainly on the back of its AI-capable chipsets.

The company has been involved with generative AI from the beginning. Nvidia was – and remains – a major provider of processor chips for OpenAI, the company that brought us ChatGPT, and also has collaborative operations with Alphabet and Amazon to provide AI-capable semiconductors – for Alphabet, to support the company’s open language models, and for Amazon, to back up the AWS subscription cloud service.

Going forward, Nvidia is well-positioned to maintain its place as the industry’s leading supplier of AI-capable chips. In March of this year, the company unveiled its Blackwell platform, as the next generation in high-end computing. The company boasts that the new architecture will enable multiple breakthroughs based on accelerated computing, powering gains in data processing, quantum computing, and generative AI – among other applications. Nvidia expects that these emerging and expanding industries will represent continuing opportunities for increased business.

And that business is substantial, to say the least. Nvidia’s last reported quarter was fiscal 4Q24, and showed a top line of $22.1 billion, growing 265% year-over-year and beating the forecast by $1.55 billion. The company’s data center segment, directly connected to its AI-related business, hit $18.4 billion in the quarter, or 83% of the total revenue. Year-over-year, Nvidia’s data center activity was up 409%, showing just how strongly the segment is driving the company’s overall growth.

Looking ahead to the fiscal 1Q25 report, scheduled for release on May 22, the Street expects to see $24.47 billion in revenue and $5.56 in earnings-per-share. Hitting those figures would represent y/y growth of 240% and 410%, respectively.

With a background like that, it’s no wonder that Nvidia has attracted rave reviews from the analysts. Among the bulls is Jefferies analyst Curtis who writes: “NVDA is our favorite within the AI basket: NVDA already captures the lion’s share of the economics of the entire AI trend. NVDA’s next-gen GPU (Blackwell) should ramp in the 2H this year with the upcoming GB200 NVL72 positioned to take even more of the AI pie in 2025… It’s still early but we have heard estimates as high as 40%+ of NVDA’s GPU volume mix next year (1.8M GPUs between 10K NVL72 and 30K NVL36 in 2025). Even 20% would be a huge shift in control of the system designs and potentially put some pressure on adjacent suppliers.”

For Curtis, this all adds up to a Buy rating for Nvidia, and a $1,200 price target that points toward a ~30% upside potential on the one-year horizon. (To watch Curtis’ track record, click here)

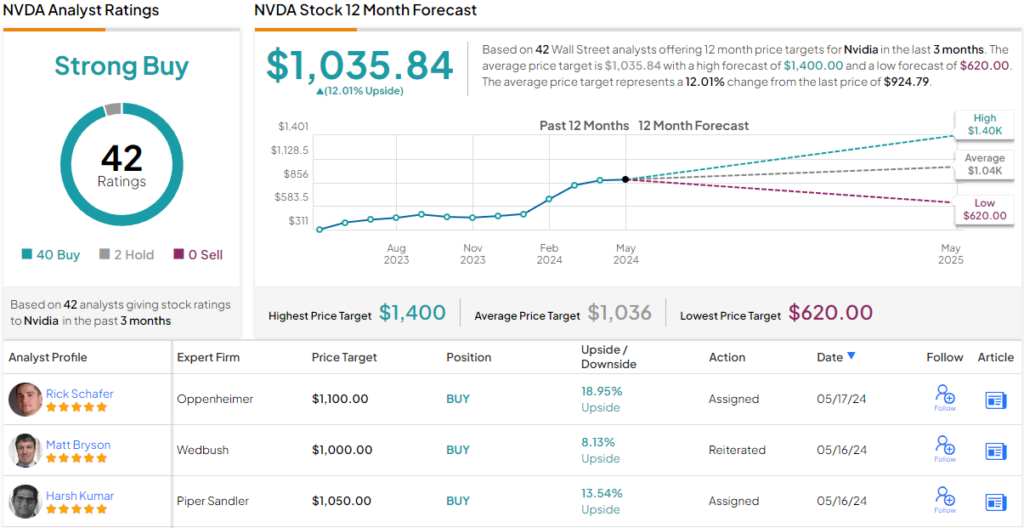

Overall, NVDA’s Strong Buy consensus rating comes from 42 recent analyst recommendations – with lopsided 40 Buys to 2 Holds. The shares are selling for $924.79, and their average target price of $1,035.84 implies a one-year upside of 12%. (See NVDA stock forecast)

Marvell Technology

Next up is Marvell Technology, a mid-sized semiconductor company specializing in chipsets for AI-related applications, such as data center infrastructure, storage accelerators, and network carriers.

Marvell bills its product line as offering the industry’s ‘most complete data infrastructure semiconductor portfolio.’ The company’s strongest revenue drivers recently have come from the AI-related fields, including its array of networking processor chips and its application-specific integrated circuit ASIC chipsets. These products offer solutions for both wired and wireless cloud computing, data storage, and networking – the applications that underlie AI applications.

Recently, Marvell caused some waves in San Diego, California, when in March the company made public several optical technology products essential to the accelerated infrastructure needed by AI firms and their related data centers. The release showcased how Marvell can provide the hardware support that is indispensable for the expansion of AI. The company’s product lines are capable of meeting generative AI’s processing speed requirements, even when the linked data centers are separated by great distances.

Looking at the financial picture, we find that Marvell is performing in-line with the analyst expectations. The company’s $1.43 billion in revenue, and 46-cent non-GAAP EPS – both reported in fiscal 4Q24 – met the forecasts. For the upcoming earnings report, to be released on May 30 and to cover fiscal 1Q25, the Street expects to see $1.16 billion at the top line and 23 cents per share at the bottom.

Top analyst Blayne Curtis is optimistic about Marvell’s long-term prospects, citing the company’s current AI success and future computing potential. He notes, “MRVL has experienced significant weakness throughout its general compute related business, offset by strength in its AI businesses (Networking & ASICs). We expect significant growth in the AI business as MRVL continues to win custom ASIC business and remains the share leader in the optical DSP market enabling the scaling of AI GPU data centers… As the general compute market begins to normalize, MRVL’s legacy business should start to recover and layer on top of the AI business that currently acts as the primary driver of the stock.”

These comments support the analyst’s Buy rating on MRVL stock, while his $85 target price implies an upside potential of 18% for the year ahead.

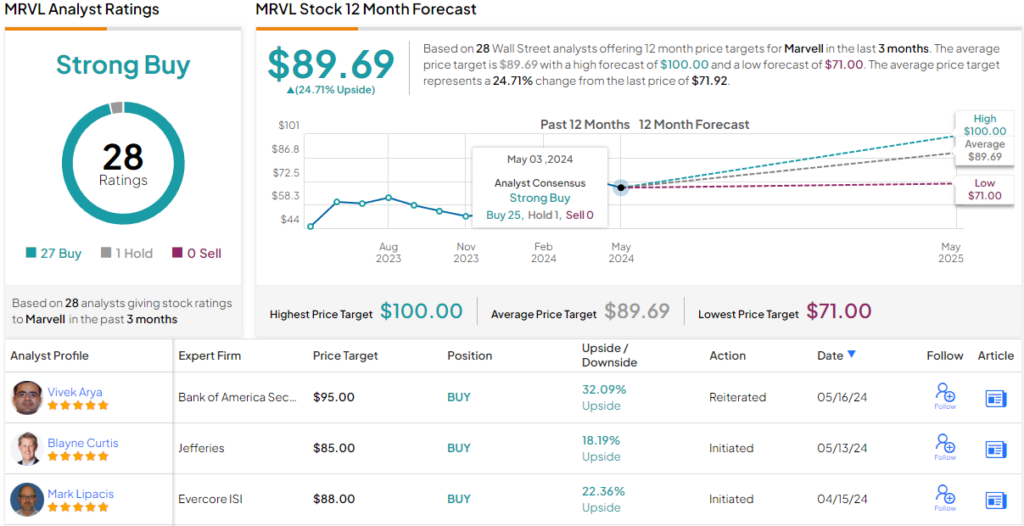

Overall, MRVL has earned its Strong Buy consensus rating from 28 recent analyst reviews – reviews that include 27 to Buy against just 1 to Hold. The shares are trading for $71.92 and their average price target of $89.69 suggests a gain of ~25% from that level. (See MRVL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

#Nvidia #Marvell #Jefferies #Picks #Chip #Stocks #Buy #Ahead #Earnings #TipRanks.com